Revolutionizing Internal Audits: How Generative AI Enhances Accuracy and Efficiency

The Growing Complexity of Internal Audits in Modern Enterprises

Internal audits have become increasingly complex as businesses navigate expanding data volumes, changing regulations, and evolving risk factors. Finance teams are under pressure to deliver fast, accurate, and insightful audits without compromising compliance or quality. Traditional audit methods, heavily reliant on manual processes, often lead to inefficiencies, human error, and inconsistent documentation.

In this digital-first era, organizations are turning to advanced technologies to drive precision and scalability in audit workflows. Among these, Generative AI is emerging as a transformative force in reshaping internal audits.

What is Generative AI and Why It Matters in Auditing?

Understanding Generative AI in Finance

Generative AI refers to a subset of artificial intelligence capable of creating new content or insights from structured and unstructured data. In the context of finance, generative AI can interpret large volumes of financial documents, generate detailed audit reports, identify compliance gaps, and suggest improvements — all while learning from ongoing feedback.

Use Cases in Internal Audit

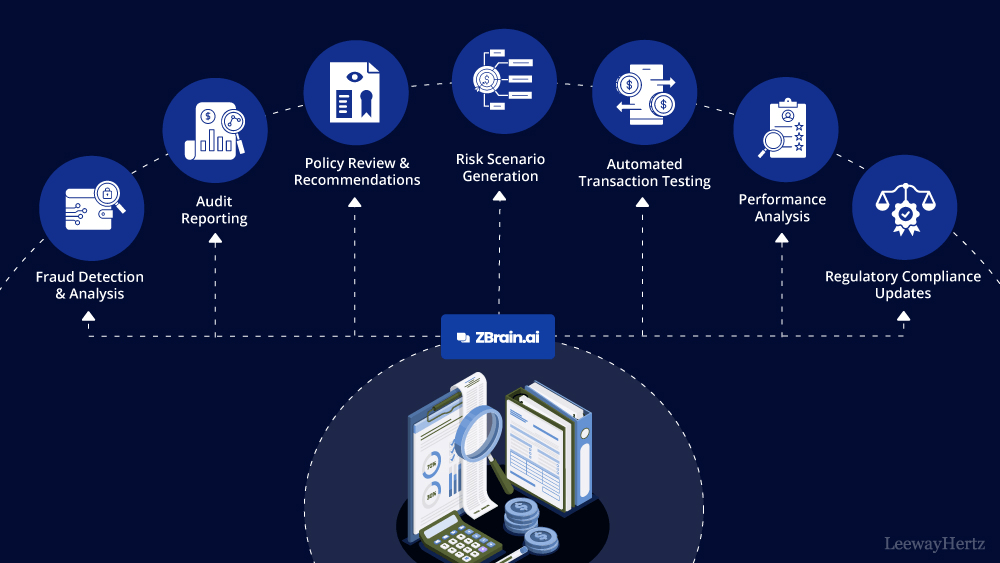

From transaction analysis to policy compliance, generative AI is increasingly being applied to:

- Automate document review and audit trail generation

- Identify anomalies and red flags in financial data

- Generate dynamic checklists and compliance frameworks

- Provide real-time recommendations for audit teams

Companies can now seamlessly integrate generative AI for internal audit to modernize their audit operations and ensure consistent regulatory alignment.

See also: Common Conditions Treated with IV Therapy at Home

Key Benefits of Generative AI in Audit Workflows

Increased Audit Accuracy and Speed

AI-driven systems can analyze thousands of transactions in minutes, reducing the risk of oversight and manual errors. It enables auditors to focus on high-value tasks like risk assessment and strategic analysis instead of spending time on data collection and validation.

Real-Time Compliance Monitoring

With regulatory requirements frequently changing, staying compliant is a moving target. Generative AI tools continuously monitor policies and updates, ensuring your audit strategy remains aligned with the latest guidelines.

Enhanced Decision-Making

AI doesn’t just automate; it enhances the quality of decisions. By generating insights based on historical patterns and predictive modeling, audit teams can better anticipate risks and proactively address them.

Automating Financial Audit Preparation with AI Agents

The Pain Points of Traditional Audit Preparation

Before an audit even begins, finance teams invest extensive time preparing relevant documentation, reconciling records, and ensuring data accuracy. This preparation phase often becomes a bottleneck, especially in large organizations with siloed financial systems.

Introducing AI-Driven Audit Preparation Agents

AI agents like the financial audit preparation agent simplify pre-audit workflows by automating document retrieval, validating data accuracy, and preparing preliminary reports.

These agents help businesses:

- Gather and classify necessary financial documents

- Check for completeness and data integrity

- Highlight missing or outdated records

- Generate structured reports for auditors

With minimal manual intervention, these agents dramatically reduce audit readiness time and ensure no critical documentation is overlooked.

Practical Implementation: How to Get Started

Step 1: Identify High-Impact Use Cases

Start by assessing areas in your audit process that are time-consuming or error-prone. This could include expense verification, reconciliation, or compliance checks.

Step 2: Choose the Right Tools

Opt for AI platforms that offer specialized audit preparation agents and customizable generative AI models. Ensure they integrate well with your existing finance systems and data sources.

Step 3: Train and Test the AI Models

Feed the system with historical audit data to help it learn organization-specific processes and compliance needs. Regular testing will refine accuracy and ensure continuous improvement.

Step 4: Monitor and Optimize

Post-deployment, monitor AI output regularly, incorporate auditor feedback, and adjust parameters to meet evolving business and compliance requirements.

Addressing Common Concerns

Is Generative AI Secure for Audit Data?

Top AI platforms implement end-to-end encryption and strict access controls to secure sensitive financial data. Additionally, many solutions are compliant with global standards like SOC 2 and ISO 27001.

Will AI Replace Human Auditors?

AI is not here to replace auditors but to empower them. It automates the mechanical parts of the audit process while enabling human professionals to focus on interpretation, decision-making, and strategic insights.

The Future of Auditing is AI-Driven

As audit demands increase in complexity and scope, relying on manual processes will no longer be sustainable. Generative AI and intelligent audit agents are ushering in a new era of proactive, real-time, and data-driven audits.

By leveraging generative AI for internal audit and deploying advanced financial audit preparation agents, organizations can not only meet compliance requirements but also unlock strategic value from their audit processes.